THE BORING

STOCK WATCHLIST

Finds you undervalued stocks with math

DESIGNED FOR

Individuals regularly adding new money to their brokerage accounts but don’t have time for in depth research.

OUR GOAL

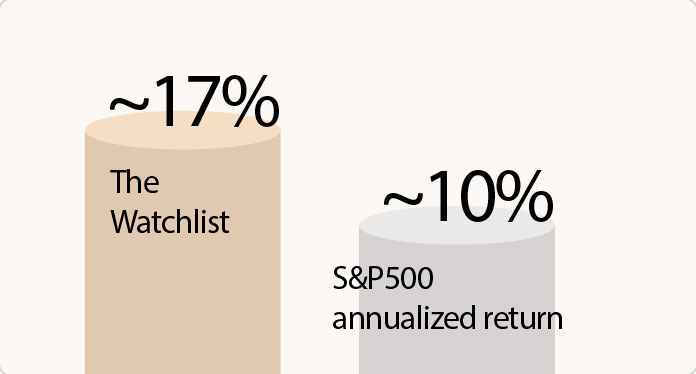

Help members to build a high quality portfolio with statistical edge over the benchmark.

KEY FEATURES

- Access the Ultimate Stock Watchlist.

- Receive 4 premium stock picks monthly.

- Get exclusive market alerts.

- Ongoing coverage of previous picks.

- Enjoy full access to market short takes.

Gain unfair advantage with data-driven picking system

The Ultimate Stock Watchlist contains 50 undervalued stocks with substantial growth potential.

Our quantitative model meticulously analyzes the market to identify the top stocks, updated weekly, that meet our stringent criteria.

Our Investment Philosophy

-

-

-

-

-

SIGN UP

| Level | Price | |

|---|---|---|

| Monthly Plan |

$39.00 per Month. (30 days money back guarantee) |

Select |

| Annual Plan |

$399.00 per Year. (30 days money back guarantee) |

Select |

Disclaimer: The information contained on the Service is for general information purposes only and is not financial advice. Please consult your financial advisor to associate the risks involved.